Charging Ahead to a Cleaner World

Energy Partner Professional Energy Purchasing (PEP) look at how the UK is responding to the government ban of new diesel and petrol vehicles by 2030, and what help is currently available to businesses.

With the recent fuel crisis causing pumps to dry out and prices to rocket, electric vehicles (EVs) have become increasingly attractive. On the date that news of fuel shortages spread across the UK, Carguide.co.uk found that online searches for electric vehicles rose by 1600%.

This is translating into sales too, with registrations last year up to more than 175,000, a 66% growth on 2019. Improvements in the battery range of electric cars, prices lowering and the EV charging network expanding have also helped to contribute to the growth.

What are the benefits of EVs?

The global market share for electric hybrid vehicles in the UK is 10.7%, one of the highest in the world.

Pure electric cars make up around a third of that, whilst plug-in hybrids continue to lead as the most popular choice. Plug-in hybrids feature an electric drive and an internal combustion engine, so can’t claim to deliver zero emissions like a pure EV, but they are a useful interim solution that allow you to drive in zero emissions electric mode when the battery is fully charged.

Advantages

- No pollution from the vehicle (low for hybrid) contributing to Net Zero targets, and although some CO2 will be produced from the electric required this is still much lower than the amount of CO2 produced using a diesel or petrol vehicle. It is possible to use renewable power or a green energy supplier for your electric to combat this.

- Lower running costs at a few pence per mile for electric versus petrol or diesel plus an exemption from road tax. For any large company fleets this can be a huge annual saving.

- Reduces impacts of events like fuel shortages and winter gas price hikes.

- No / low congestion charges.

- Reduced noise pollution.

Disadvantages

- Electric cars are more expensive to buy than their equivalent petrol vehicle.

- You are normally limited by range and speed although this is improving with newer cars.

- Electric vehicles can be more expensive to insure than normal cars.

- You need to have access to a recharge point with normal recharging time taking between 6-8 hours for a full charge, although more rapid chargers are being installed across the UK.

- Batteries will need replacing anything from 3 to 10 years depending on battery type and amount of driving.

Installing EV charging points There are tons of initiatives driving the growth of EV charging points across the UK to help speed up the growth needed to hit government targets.

There are tons of initiatives driving the growth of EV charging points across the UK to help speed up the growth needed to hit government targets.

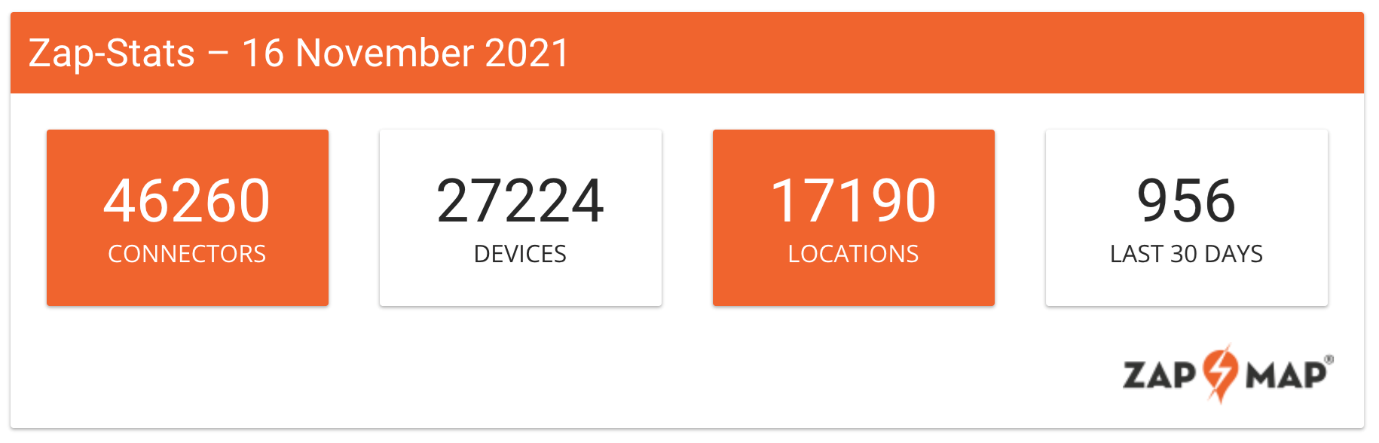

With just over 17,000 public charging points across the UK, and only 5.3% of devices installed in the Yorkshire and the Humber region, there’s still a way to go.

Companies are tackling this issue by investing in onsite charging points at their premises to provide charging for staff and visitor EV vehicles. Bear in mind EVs will have different charging connectivity needs, so it’s important to install a charging point most likely to be compatible with the widest range of vehicles possible.

EV financial incentives

There are several grants, funding and tax benefits available for electric vehicles.

Workplace charging scheme

The Workplace Charging Scheme allows businesses, charities, and local authorities to claim 75% of the total cost of the installation of an EV charging point, up to a maximum of £350 per socket installed with a maximum of 40 sockets across all sites.

There is also a grant available to help with the cost of fitting a charging point to your home.

Plug-in vehicle grant

The Government Plug-in Car Grant is a £2,500 discount applied to brand-new low emission vehicles with an initial RRP less than £35,000. It is currently limited to full-electric vehicles because of the emission criterial but future hybrid vehicles may qualify soon.

To take advantage of the grant you just have to buy an eligible vehicle – it’s as simple as that. The £2,500 grant deduction is automatically applied, and the dealer will claim the money back after the sale.

Both schemes under the Office for Zero Emission Vehicles could end at any time, a common practice with government initiatives, so we recommend taking advantage of these now.

EV company car tax benefits

The more CO2 a car emits, the higher the percentage of a company car’s value is taxed – called the Benefit in Kind (BiK) rate .

EVs have the most attractive BiK rates, but plug-in hybrids also attract less tax.

Pure electric cars for the 2021/22 financial year have a BiK rate of one per cent, and in 2022/23 just two per cent. This means company car drivers who choose an EV will save thousands compared with the driver of a comparable diesel.

View here for more details on company car tax.

Local council grants

Keep a look out for any local incentives to help fund your switch to EV. Currently Sheffield council have money available to help businesses upgrade their vehicles to be compliant with the new clean air zone – something that will become chargeable late 2022.

EV charging testimonial

“The team at PEP are always really professional and helpful and our on-site EV charging points request was no different. Our initial discussion with MD Linda Spencer led to a site survey and agreed installation date within just two days. Linda also advised me how to access the current government funding available which was an added bonus and unexpected saving.

The whole process was hassle-free and successfully installed within three weeks from our initial conversation.”

Ian, Sales Director at Northend Printers

View the full case study here

Get in touch

PEP help businesses identify energy and carbon emission savings, buy green energy, and plan for Net Zero. They can also help with the application for funding and installation for business EV charging points.

Get in touch for your free initial consultation.

0114 327 2645

Sorry, the comment form is closed at this time.